Bitfarms is poised to expand its bitcoin mining capacity in the U.S. through a stock-for-stock merger with Pennsylvania-based Stronghold Digital.

Bitfarms announced the agreement on Wednesday, with CEO Ben Gagnon revealing that it followed “three years of ongoing discussions.” The deal is valued at $125 million in equity, with an additional $50 million in assumed debt.

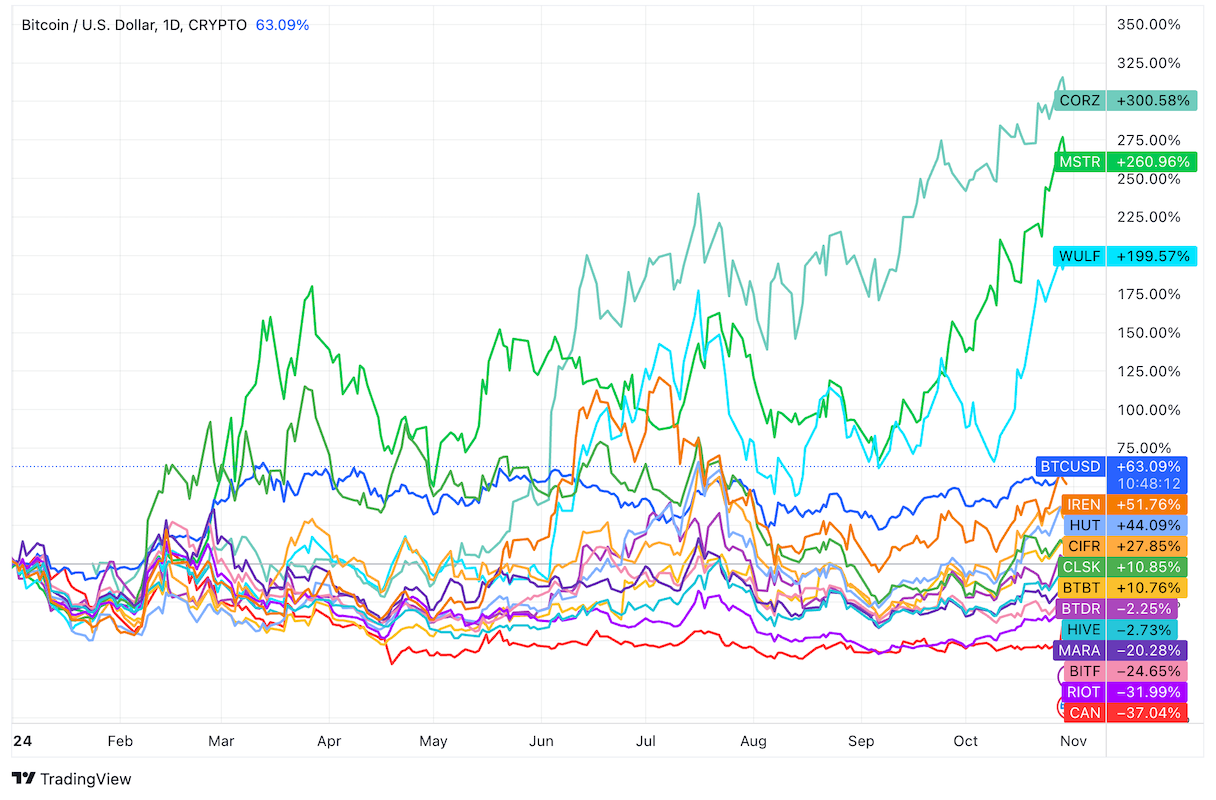

This deal represents the latest consolidation in the bitcoin mining industry following the Halving while Bitfarms itself is fending off a hostile takeover attempt by U.S. rival Riot Platforms.

The transaction also comes just months after Stronghold publicly expressed its intention to sell parts or all of its assets, including its power generation and bitcoin mining capacities.

According to Stronghold’s Q2 filing, the company was operating 4.1 EH/s of hashrate in Pennsylvania, powered by 165 megawatts (MW) of proprietary power plants. Stronghold owns 3.1 EH/s of this capacity for proprietary mining while colocating 1 EH/s for profit-sharing and hosting clients.

Bitfarms expects to close the transaction in Q1 2025, which would result in an immediate expansion of 4 EH/s, with the potential to scale to over 10 EH/s following a fleet upgrade. Additionally, Bitfarms noted that Stronghold has 142 MW of current Pennsylvania-New Jersey-Maryland Interconnection (PJM) import capacity.

“With this transaction, we anticipate expanding and rebalancing our energy portfolio to 950 MW, with nearly 50% located in the U.S. by the end of 2025,” Gagnon said in the release. “We also have visibility on multi-year expansion capacity up to 1.6 GW, with approximately 66% in the U.S., up from approximately 6% today.”

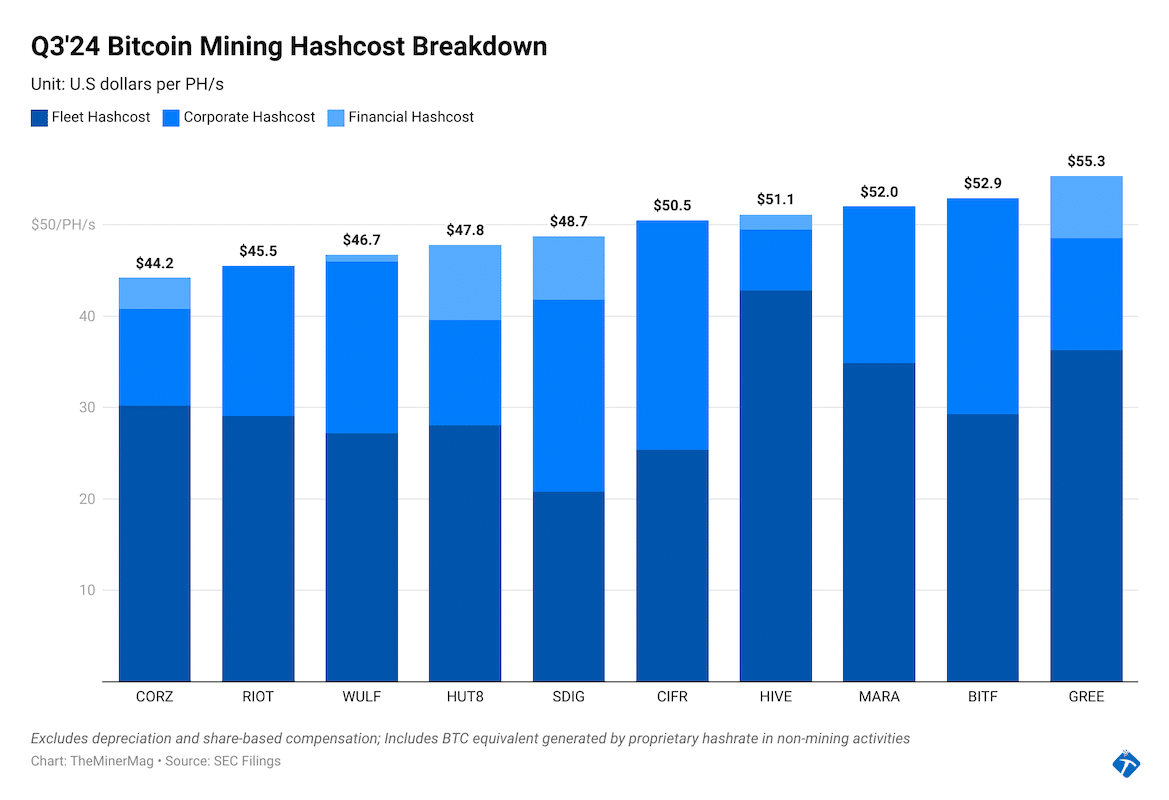

Stronghold, based on its quarterly filings, had one of the lowest fleet hashcosts in the industry, though this was heavily subsidized by its energy generation segment. The company went public in 2021 but has struggled with highly leveraged financial positions.

In February 2023, Stronghold restructured a $55 million outstanding loan with Whitehawk Finance, amending key components of their credit agreement. While the principal amount and the 10% coupon rate remained unchanged, the amended agreement allowed Stronghold to postpone the mandatory amortization of the principal until June 2024, after which a $1.6 million monthly amortization will begin.

As part of the all-stock merger deal, Stronghold shareholders will receive 2.52 shares of Bitfarms for each share of Stronghold they own, representing a consideration of $6.02 per Stronghold’s common stock.

Stronghold’s stock price jumped up 72% after the market opened on Wednesday to over $5 per share while Bitfarms’ stock dropped by 7%.

Share This Post: