This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

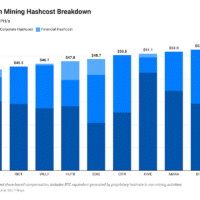

13 U.S-listed mining companies have reported their Q2 earnings so far, revealing a common theme: the need for cash is not slowing down. According to calculations by TheMinerMag, this urgency is driven by the state of bitcoin’s hashprice, which is not generating a meaningful cash flow after the halving. To mitigate this, some are also turning to debt financing once again.

Nine out of the 13 companies – Bitdeer, Bitfarms, Cipher, CleanSpark, Core, HIVE, Marathon, Riot, and Terawulf – collectively raised $1.25 billion via various stock offering programs during Q2. Iris Energy has not yet disclosed its earnings but reportedly raised $458 million in Q2 through an at-the-market offering.

Based on this, TheMinerMag’s dashboard shows that public mining forces raised over $1.6 billion via equity financing over the first quarter since the halving and an additional $530 million in Q3 so far.

Although that number didn’t beat the record of nearly $2 billion raised in Q1 by stock offerings of mining pubcos., it is interesting to note the rise of convertible notes and asset-backed loans again in Q2.

The debt financing tab shows that public mining companies have been consistently deleveraging their financial positions over the past two years since the Luna collapse. While many companies continued to do so during Q2, their combined debt financing turned positive because Hut 8, which did not raise any proceeds from stock offerings, received proceeds of $150 million via the Coatue notes.

Additionally, in the past week, we saw Marathon and Core Scientific offer convertible notes totaling $700 million. In Core’s case, the new convertibles were part of a debt restructuring effort, replacing existing debt with notes at a lower interest rate. For Marathon, the convertible notes were mostly used to acquire additional bitcoin from the market. CleanSpark disclosed in its Q2 filing that it has entered into credit facilities with Coinbase for loans collateralized by bitcoin. Canaan stated that it pledged 530 BTC during Q2 to secure term loans totaling $19.2 million for 18 months.

This is all but surprising given bitcoin’s low hashprice around $43/PH/s – and that is after a 4.2% difficulty ease adjusted today.

Regulation News

- Russia Officially Legalizes Crypto Mining - TheMinerMag

Hardware and Infrastructure News

- CleanSpark Orders 7.8 EH/s of S21XP Bitcoin Miners for $167M - TheMinerMag

Corporate News

- Bitcoin Miner With Celsius Assets Delays IPO After Losing CEO and Auditor - CoinDesk

- Bitfarms Founder Steps Down in Leadership Overhaul - TheMinerMag

- Marathon Buys Bitcoin with $249M from Convertible Notes - TheMinerMag

- Riot Buys Another 1 Million Bitfarms Shares, Increasing Ownership Stake to 18.9% - The Block

Financial News

- Argo Repays Galaxy Debt after Equity Raise - TheMinerMag

- Marathon Plans $250M Convertible Notes to Buy Bitcoin - TheMinerMag

- Tampa bitcoin company gets $5.6M loan to buy Texas mining facility - Business Observer

- Core Scientific Eyes $350M Notes to Repay Bitcoin Mining Debt - TheMinerMag

Feature

- Hashprice, Iris Energy’s Failed Hedge and Paraguay Mining - The Mining Pod

- The Road To 20 EH/s With Zach Bradford - The Mining Pod

- Where bitcoin miners stand after Q2 disclosures - Blockworks

Share This Post: