Argo Blockchain has fully repaid its remaining loans to Galaxy Digital, originally taken out during the bear market of December 2022, marking a major step in strengthening its balance sheet.

The London-listed bitcoin mining firm reported that the remaining loan balance, approximately $5.7 million as of June 30, was fully repaid by August 9. Argo had previously extended the loan’s maturity date by six months from June 30 to the end of the year.

This debt repayment came less than two weeks after Argo announced an equity raise of $8.35 million via a private placement.

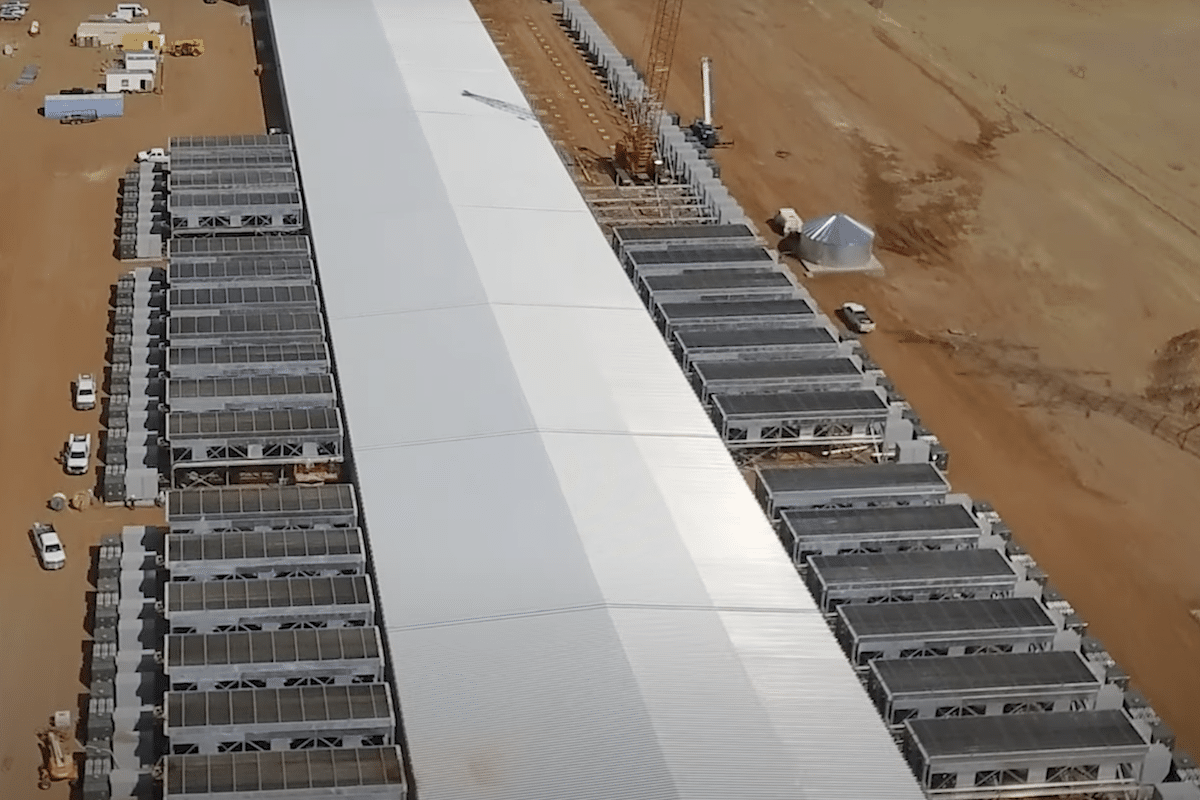

Argo originally secured the $35 million loan from Galaxy Digital in December 2022 and sold its flagship Helios mining site in Texas to Galaxy for an additional $65 million. The proceeds were used to repay other liabilities as the broader crypto market bottomed out.

In 2023, Argo repaid $11.5 million of the principal, with the remaining $23.5 million cleared in 2024. Interest expenses on the Galaxy debt amounted to $4.6 million in 2023, compared to $1.4 million up to the repayment date in 2024.

Meanwhile, the company’s mining operations appears to be struggling to generate net cash flows – just like many other operators at the moment – as bitcoin’s hashprice has dropped below Argo’s fleet breakeven point.

Since the 2022 transaction, Argo has been colocating the majority of its mining fleet at the Helios site as a hosting customer of Galaxy. Its realized hashrate has remained around 2 EH/s, with an estimated fleet hashcost of $57/PH/s in Q1, not including a corporate hashcost of $17.2/PH/s.

Following the recent market downturn and an all-time high network difficulty, bitcoin’s hashprice, the daily revenue per each unit of hashing power, is now hovering around $41/PH/s.

Share This Post: