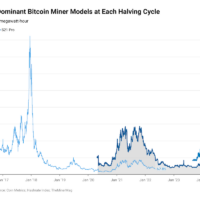

Three of the largest bitcoin mining operations, with a combined market share of nearly 10%, have made hardware deposits totaling $150 million since Q2 to chip manufacturers alternative to Bitmain.

Marathon, Core Scientific, and Riot Platforms have made respective advance payments to Auradine, Block, and MicroBT as these companies diversify away from their previous reliance on Bitmain.

Marathon stated in its Q2 filing last week that it made an additional advance payment of $29.1 million over the last quarter to Auradine for the future purchases of its Teraflux bitcoin miners.

This followed a $15 million advanced payment made during Q3 last year, brining Marathon’s total deposits made to the upstart bitcoin ASIC chip designer to $43.6 million. Marathon has also made an equity investment into Auradine with a carry value of $48.7 million.

Core Scientific disclosed in its Q2 filing that it has paid a $10 million deposit following its July announcement of procuring a 15 EH/s bitcoin ASIC system from Block Inc. The delivery of these ASIC chips is expected to begin by the end of 2025.

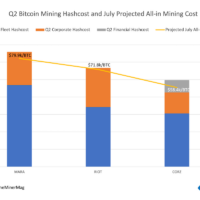

This order came shortly after Core received all previously ordered Antminer S19jXP and S21 units from Bitmain, totaling 6.7 EH/s. Approximately $50 million of this payment was made with Core’s common stock, making Bitmain a shareholder in the company.

Riot Platforms, which announced a bulk preorder of WhatsMiners last year, said it made about $110 million in deposits and advanced payments during Q2 to MicroBT. Through June 30, Riot paid a total of $412.9 million to the biggest competitor of Bitmain and had a remaining commitment of $148 million.

Last month, Auradine announced the initial deliveries of its Teraflux 2800 series bitcoin miners with the production volume to ramp up in Q3. MircoBT also launched the M6XS+ WhatsMiner models during the Bitcoin 2024 touting an efficiency 17 J/TH.

Share This Post: