Bitcoin mining giant Marathon is doubling down on its digital asset reserves with a purchase of $100 million worth of BTC.

The company announced on Thursday that it now holds over 20,000 BTC on its balance sheet, valued at $1.28 billion. Marathon ended June with a reserve of 18,536 BTC, indicating that it bought approximately 1,500 BTC from the market at an average price of around $65,000 per bitcoin.

Additionally, Marathon revealed it will return to a full HODL (Hold On for Dear Life) approach towards its bitcoin treasury policy, “retaining all bitcoin mined in its operations and periodically making strategic open market purchases.”

This approach marks a shift from Marathon’s current strategy, where it had been selling a portion of its monthly bitcoin production to fund its operating expenses. The market purchase follows extensive equity financing that Marathon raised since the second half of 2023. The company raised $472 million in Q1 alone from stock offerings.

“Adopting a full HODL strategy reflects our confidence in the long-term value of bitcoin,” said Fred Thiel, Marathon’s chairman and CEO. “We believe bitcoin is the world’s best treasury reserve asset and support the idea of sovereign wealth funds holding it. We encourage governments and corporations to hold bitcoin as a reserve asset.”

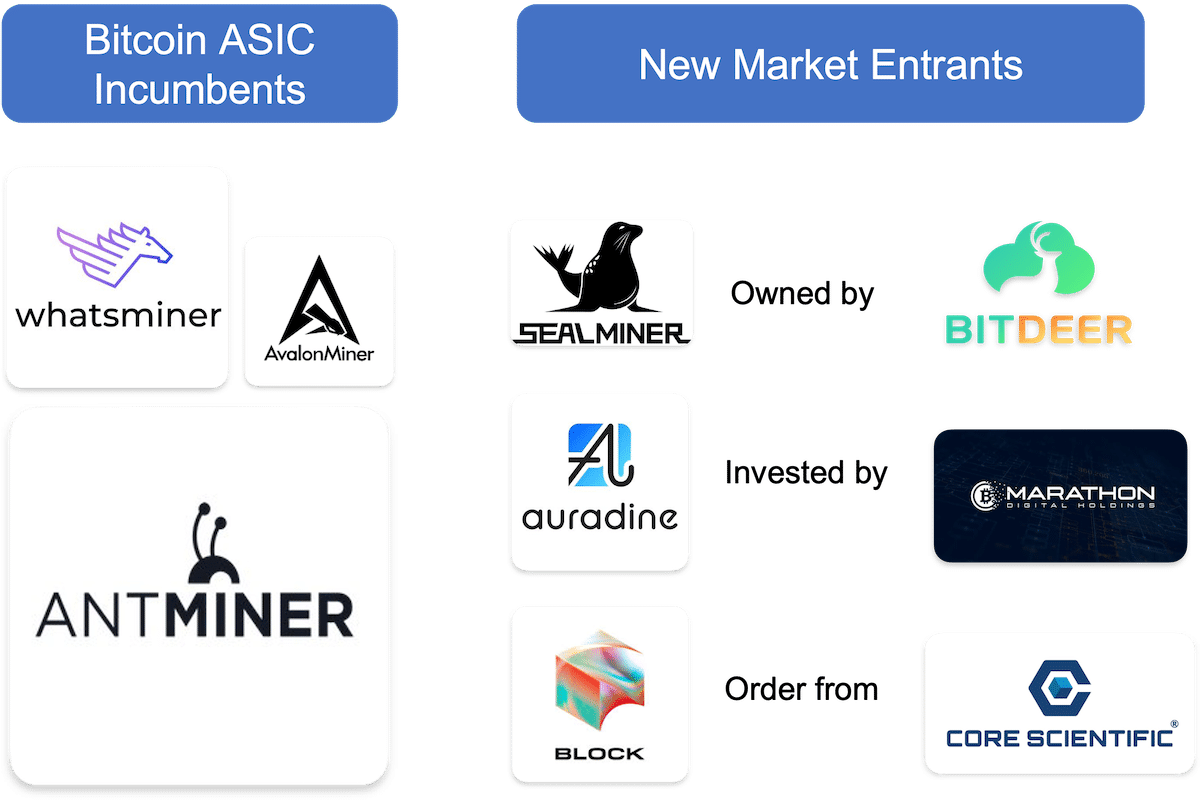

Marathon is currently the largest public bitcoin mining firm, with close to 30 EH/s in realized hashrate. The company previously adopted a full HODL strategy in 2021 but later began liquidating some of its monthly production following the 2022 bear market.

Share This Post: