The stock of U.S. bitcoin mining firm GRIID is experiencing a sharp increase in trading volume following rumors on Wednesday that it could be acquired by mining rival CleanSpark.

GRIID’s stock is trading at $1 after the market opened on Thursday, up 80% compared to its closing price of $0.56 on the previous trading day.

During pre-market hours on Thursday, GRIID’s trading volume already surged to over 30 million shares, which was 200 times its average volume, based on data from Yahoo Finance.

Mike Alfred, managing partner at Alpine Fox and a non-executive director at Iris Energy, speculated on Wednesday in a post on X that it “seems highly likely” CleanSpark will acquire GRIID based on “numerous” discussions and inferences he has made.

GRIID went public earlier this year after completing a SPAC merger that was first announced in 2021 but postponed multiple times amid the bear market in 2022.

According to GRIID’s Q1 report, it had 68 megawatts (MW) of available capacity, with 48 MW dedicated to proprietary mining.

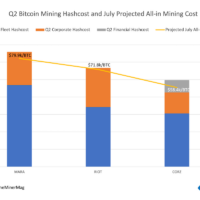

However, the company only mined 66 BTC in the first quarter with a realized hashrate of 0.41 EH/s, suggesting GRIID was either still operating a fleet of legacy miners or not running at full capacity.

As previously reported, GRIID installed over 20,623 miners, producing a hashrate of 0.47 EH/s as of June 2023. This implies GRIID’s fleet at the time mostly consisted of older-generation equipment with an average hashrate of 21 TH/s per miner.

Share This Post: