Riot Platforms, one of the largest publicly traded bitcoin mining companies, has raised $500 million via stock offerings year-to-date, the company said on Wednesday.

In its Q1 earnings release on May 1, Riot disclosed that it raised $345.7 million in net proceeds from its at-the-market (ATM) offerings during the quarter and received an additional $154.1 million in April. This suggests that Riot has utilized two-thirds of its $750 million ATM program registered earlier this year.

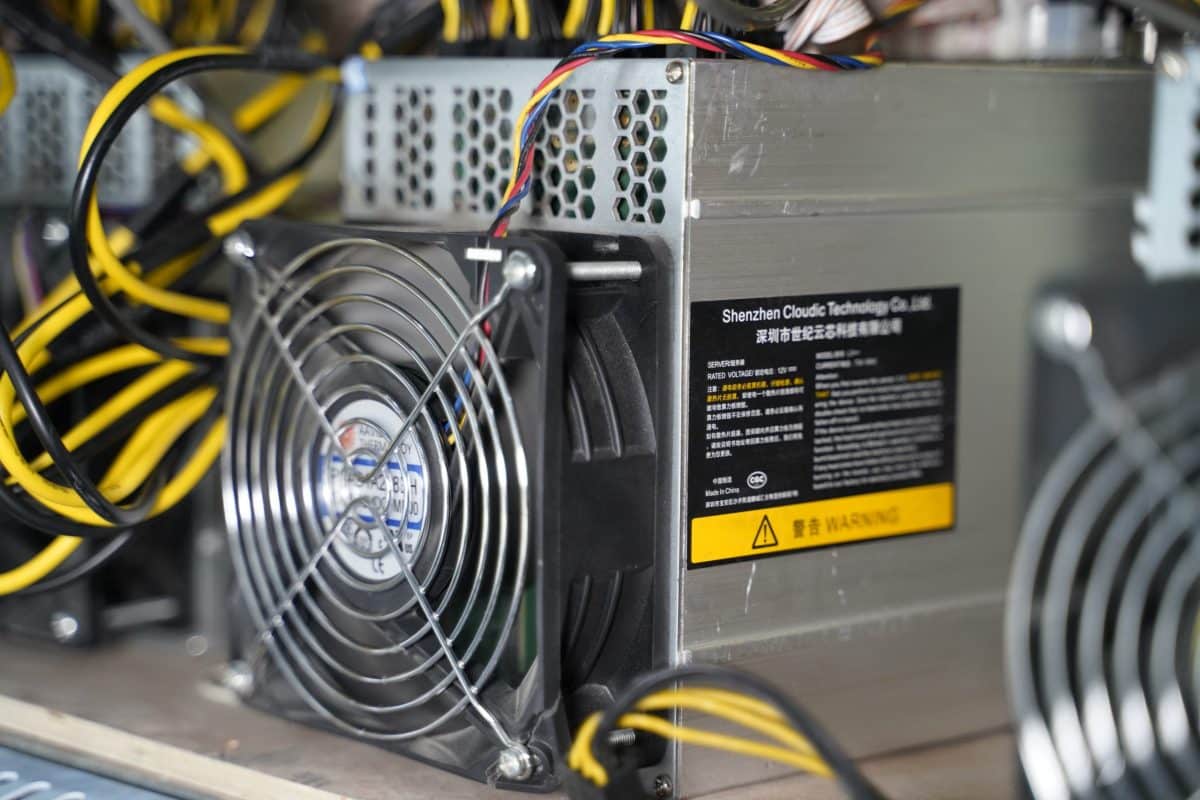

The proceeds will mainly be used to fund its infrastructure expansion in Texas and miner purchase commitment as part of an arms race among major public mining companies in North America.

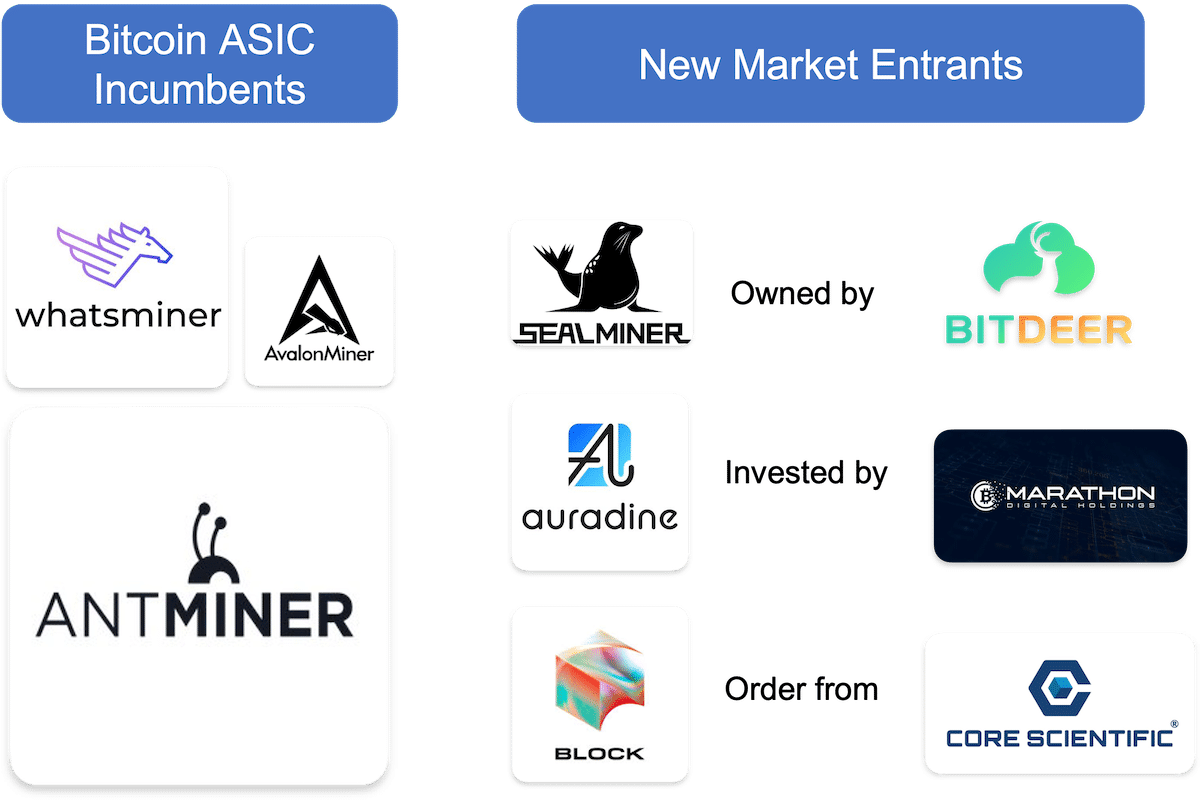

Upon fully deploying its preordered Whatsminer equipment from 2023 and completing its 1 gigawatt (GW) facility in Corsicana, Texas, Riot projects its total hashrate to reach 41 EH/s by 2025.

Riot reported a bitcoin mining revenue of $74.6 million for the first quarter and a cost of mining revenue of $41.1 million. It also received $5.1 million worth of power credits.

Regarding other corporate overhead, Riot incurred an estimated $24.2 million in Selling, General, and Administrative expenses for the mining segment, net of share-based payments.

Overall, Riot’s total hashcost spiked to $80/PH/s in Q1, consisting of $49/PH/s in fleet hashcost and $31/PH/s in corporate hashcost, according to TheMinerMag’s analysis. This represents a 41% and 88% increase on a quarter-over-quarter and year-over-year basis, respectively. The estimation factors the bitcoin equivalent from power credits and excludes non-cash expenses such as depreciation and share-based payments.

One reason behind the hashcost jump may have been Riot’s termination of its data center colocation business amid several legal disputes with its former customers and the previous owner of the Whinstone site.

In previous quarters, Riot’s self-mining segment was reported as one of the few customers of its own Whinstone colocation subsidiary, allowing Riot to report a favorable cost of mining revenue at the expense of the data center hosting revenue.

For instance, based on Riot’s annual report for 2023, its data center business recorded a revenue of $27 million and a cost of hosting revenue of $97 million. Even including a power credit of $25 million that was allocated to data center hosting, Riot would still record a gross loss of $45 million for the segment.

As of Mar. 31, Riot held $688.5 million in cash with 8,490 BTC.

Share This Post: