Bitcoin mining firm Iris Energy has raised $261 million through its latest at-the-market (ATM) stock offering so far, of which about $120 million worth of shares were sold over the past month.

The company noted in a filing on Thursday that it has revised the maximum offering of its September ATM program from $200 million to $500 million, of which $261 million has been sold as of March 15.

According to Iris Energy’s earnings report for Q4, it raised $24 million from the September ATM offering during the period and raised another $92 million between the New Year and Feb. 15. The firm appears to have secured an additional $120 million in equity funding since then.

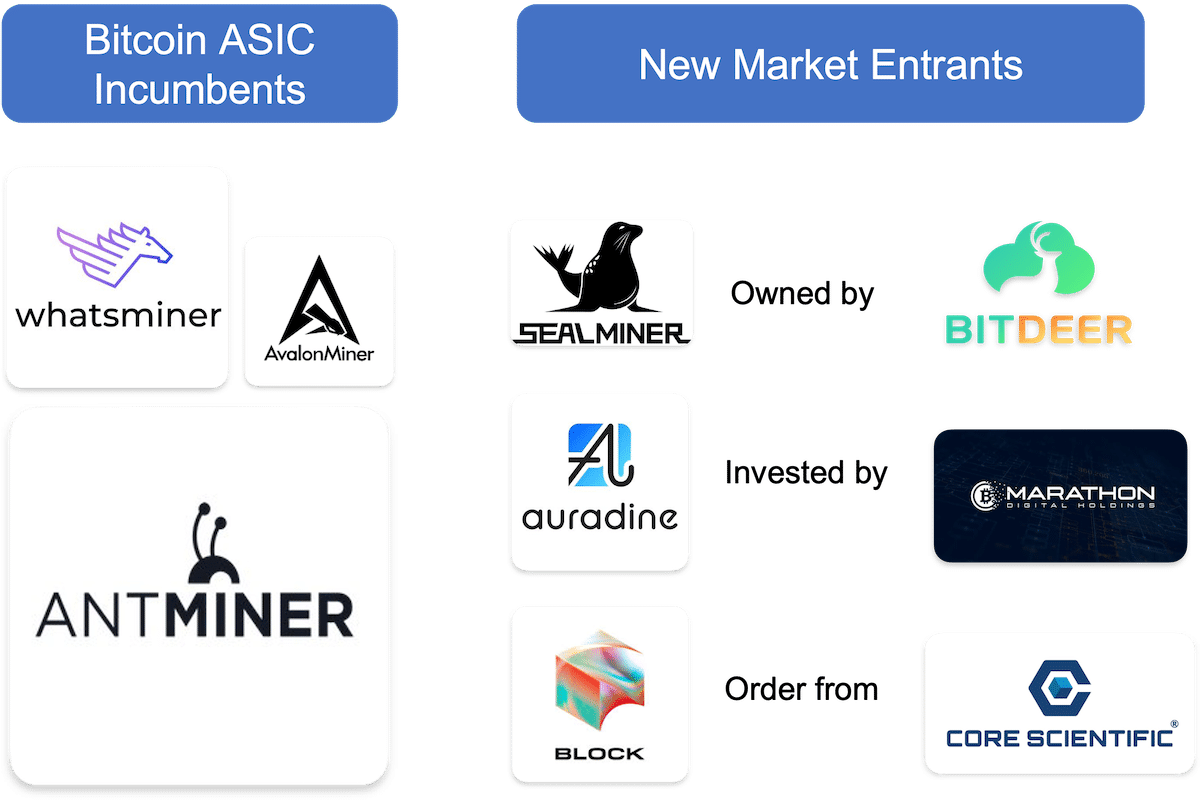

Iris Energy had cash liquidity of $90 million as of Dec. 31 and a contract commitment of about $50 million for mining equipment. It announced an additional purchase for 1 EH/s of Bitmain’s T21 miners in January for $13.3 million with an option to buy an extra 9.1 EH/s for $127 million. It remains to be seen if the company will fully exercise the option to significantly scale up its mining fleet.

As previously reported, Marathon, Riot, and CleanSpark have already raised over $740 million since the New Year through equity offerings. New filings over the past weeks show that Bit Digital and Terawulf also raised $33.5 million and $50 million in Q1, respectively. Together with Iris Energy, the six mining firms have raised over $1 billion during the quarter.

Share This Post: