BitFuFu, a bitcoin cloud mining and proprietary mining firm backed by hardware giant Bitmain, has closed its merger with a special purpose acquisition company (SPAC) to list on the Nasdaq stock exchange.

In an announcement on Thursday, BitFuFu said its Class A ordinary shares will begin trading on Friday under the ticker FUFU. The completion of the SPAC merger has come more than two years since BitFuFu submitted the plan only to have postponed the deadline multiple times.

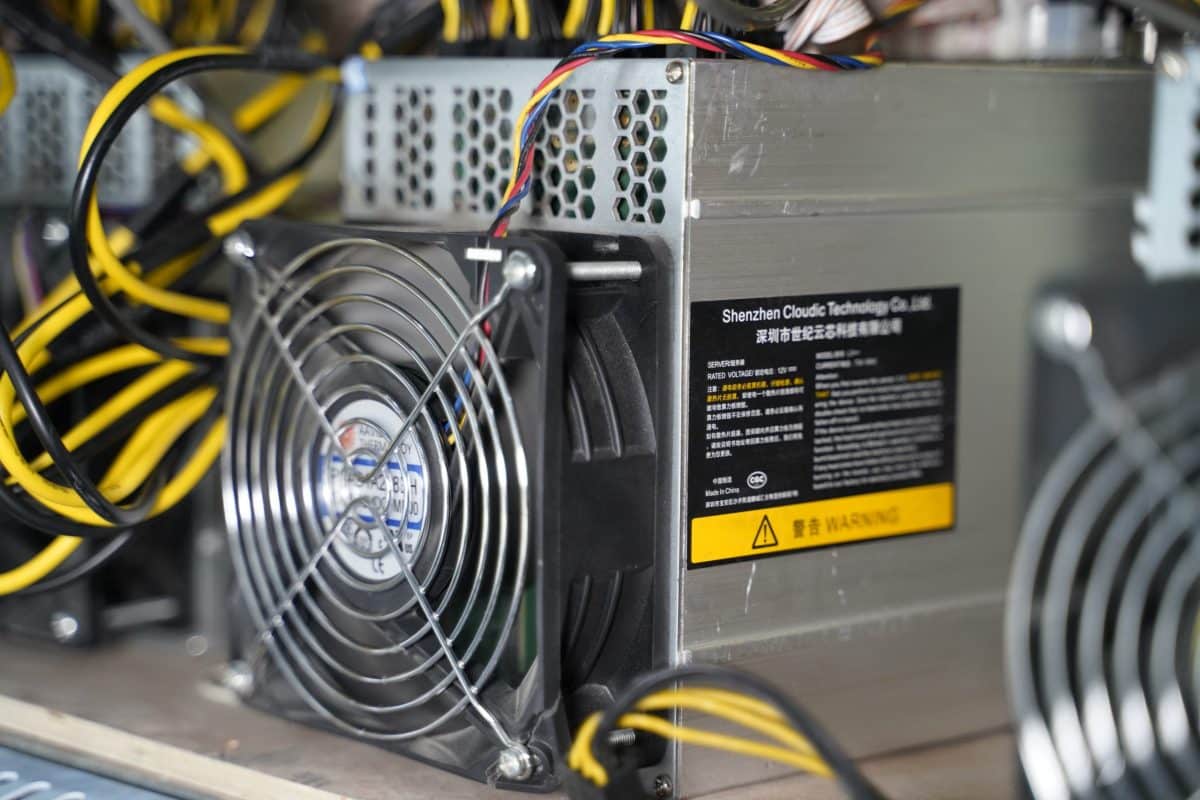

BitFuFu said it had 15.2 EH/s in operating hashrate as of June 30, 2023, with 131,000 miners under its management. However, it only owned 20,600 units and was leasing 105,800 from Bitmain, which owns 5% of BitFuFu. The rest were hosted miners owned by BitFuFu’s colocation clients at the time.

BitFuFu generated a revenue of $134 million for the first half of 2023 by self-mining 2,253 BTC and selling cloud-mining contracts for $75.16 million. It also made $3.17 million from hosting.

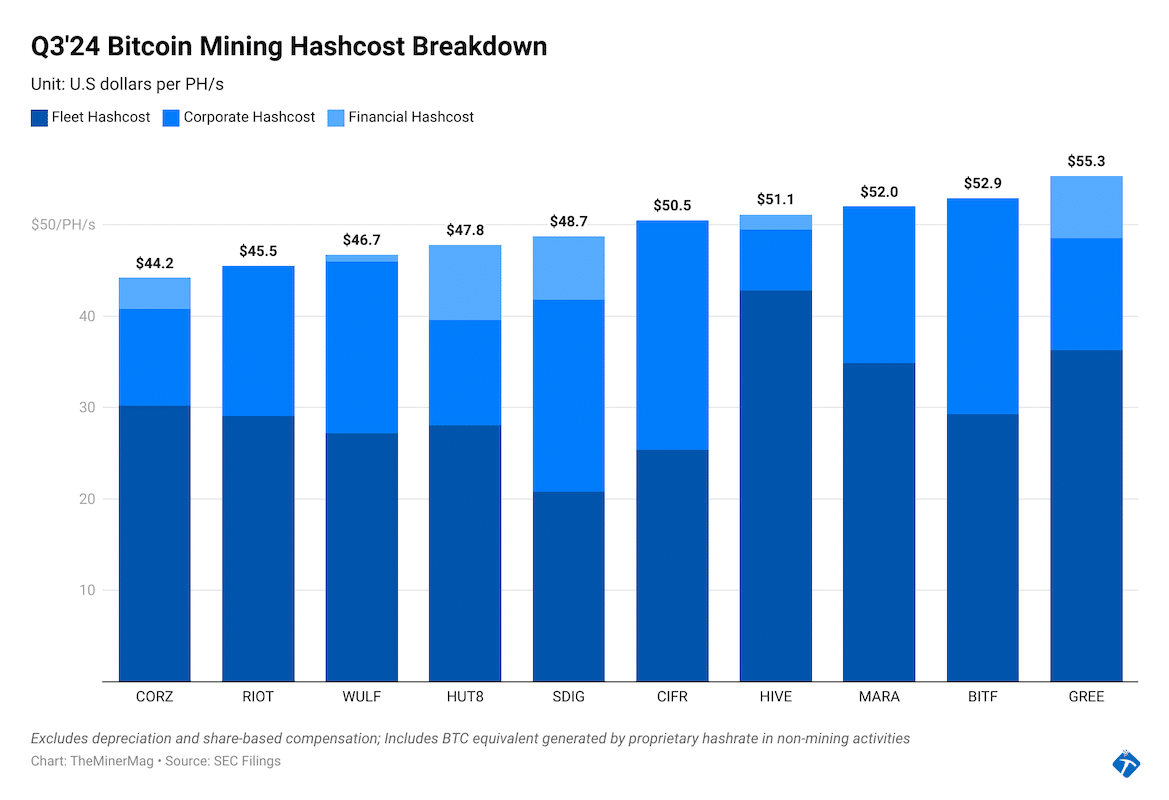

Its cost of revenue during the same period was $111.4 million, suggesting a gross margin of 17%. Since BitFuFu rented 80% of its fleet from Bitmain while using Bitmain’s sites to power up the machines for self-mining, hosting, and cloud mining, 78% of its total cost of revenue – or $87 million – was paid to Bitmain in H1’23. That indicates its business dependence on the relationship with Bitmain.

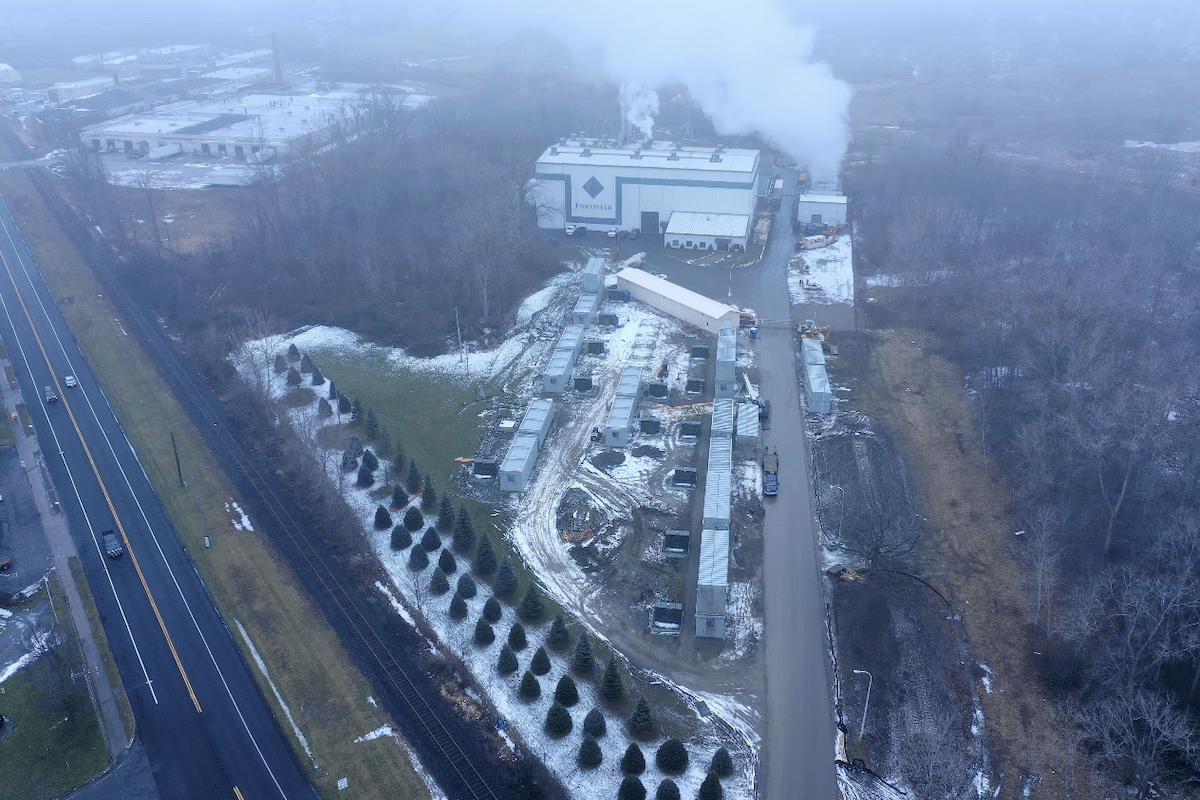

BitFuFu added in its prospectus that it had access to about 374 MW of power capacity at 17 mining sites in the U.S., Portugal, Kazakhstan, and Laos through Bitmain. The average electricity fee it paid in the first half of 2023 was $73.8/mWh and has been renting more S19XPs from Bitmain to lower the cost since November 2022.

Also notably, it appears that BitFuFu had $2.1 million of stablecoins and 480 BTC stuck at FTX following the exchange’s filing for bankruptcy.

More details were discussed in this research post published in January, which was initially behind a paywall and is now made publically available.

Share This Post: