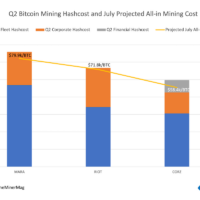

Several public bitcoin mining companies have reported much higher electricity costs per each bitcoin they mined in January due to the rising competition and elevated power rates.

In a production update on Wednesday, Iris Energy said its electricity cost jumped to $18,705 per BTC in January, which was up 29% from December.

“The increase in electricity costs per bitcoin mined ($18.7k vs. $14.9k in December) was primarily attributable to lower network transaction fees as well as higher electricity prices and reduced market volatility at Childress [Texas] (lower energy trading proceeds),” the firm said in the announcement.

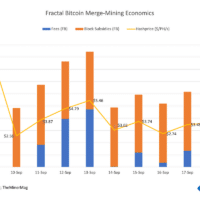

Indeed, bitcoin’s transaction fees in December contributed to 25% of the month’s total block rewards, which increased to over 36.6k BTC. January’s block rewards declined to just over 31k BTC as the transaction fees subsided.

Terawulf also reported earlier this week that its power cost per bitcoin surged to $16,737, which was up nearly 50% from December. Over the past six months, Terawulf’s average cost of bitcoin production was less than $11,000.

Sean Farrell, Terawulf’s senior vice president of operations, noted the “seasonally elevated power prices due to colder than average temperatures in upstate New York” affected the company’s production.

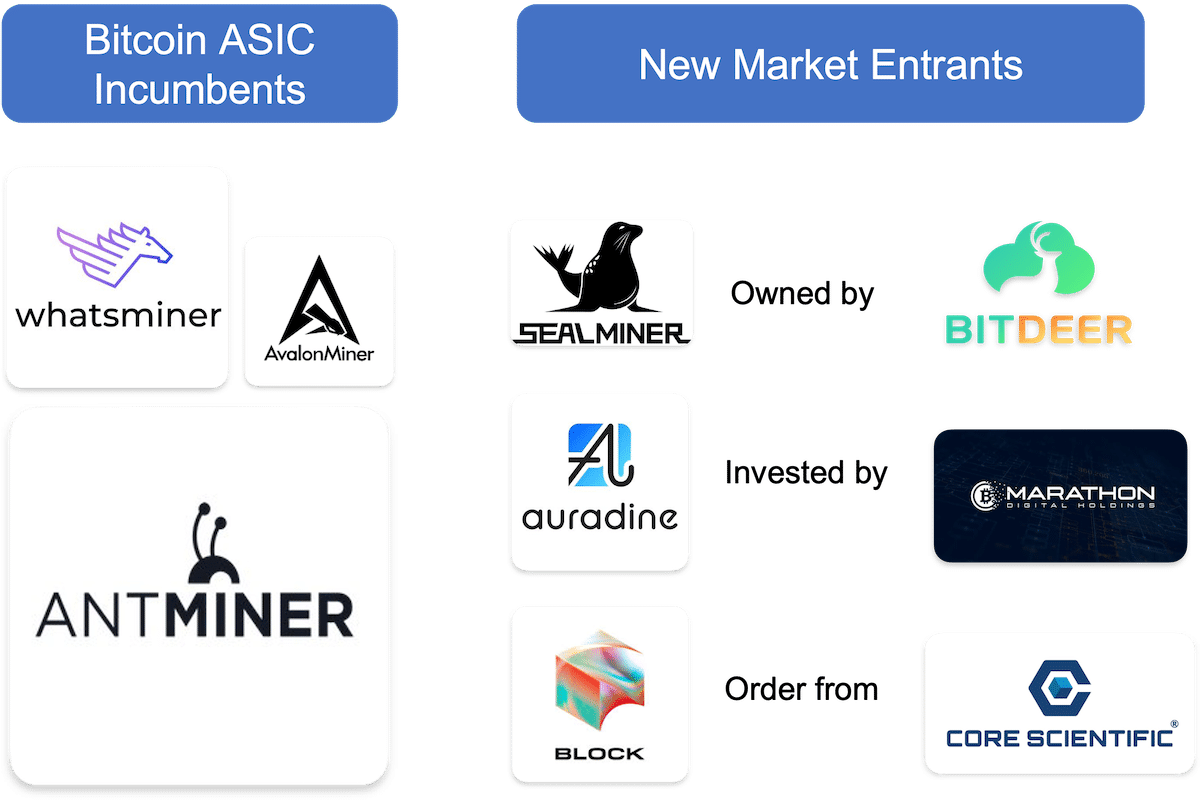

Bitdeer, on the other hand, said it curtailed its hashrate at the Gedu datacenter in Bhutan due to “seasonally higher electricity costs, which may continue through the remainder of the first quarter.”

The three mining companies all mined less bitcoin in January compared to December mainly because of the rising network hashrate, which pushed bitcoin’s daily production benchmark to an all-time low below 2 BTC/EH/s in January.

For each EH/s of computing power, they were generating less bitcoin in January than previous months while the power cost for running such computing power increased due to extreme weather conditions.

As previously reported, the cold outbreak in Texas resulted in a 25% decline in bitcoin hashrate for three days in mid-January but the network competition soon went full back up and set new difficulty records.

Share This Post: