North American bitcoin mining and colocation firm Hut 8 claims that it could generate $81.5 million in cash revenues over the next four years by managing the restructured bitcoin mining assets of the now-defunct crypto lender Celsius.

Hut 8 announced on Thursday that it has signed a four-year service agreement with Ionic Digital, the new Celsius entity that officially emerged from Chapter 11 bankruptcy reorganization on Wednesday. Additionally, Hut 8 has taken equity ownership in Ionic.

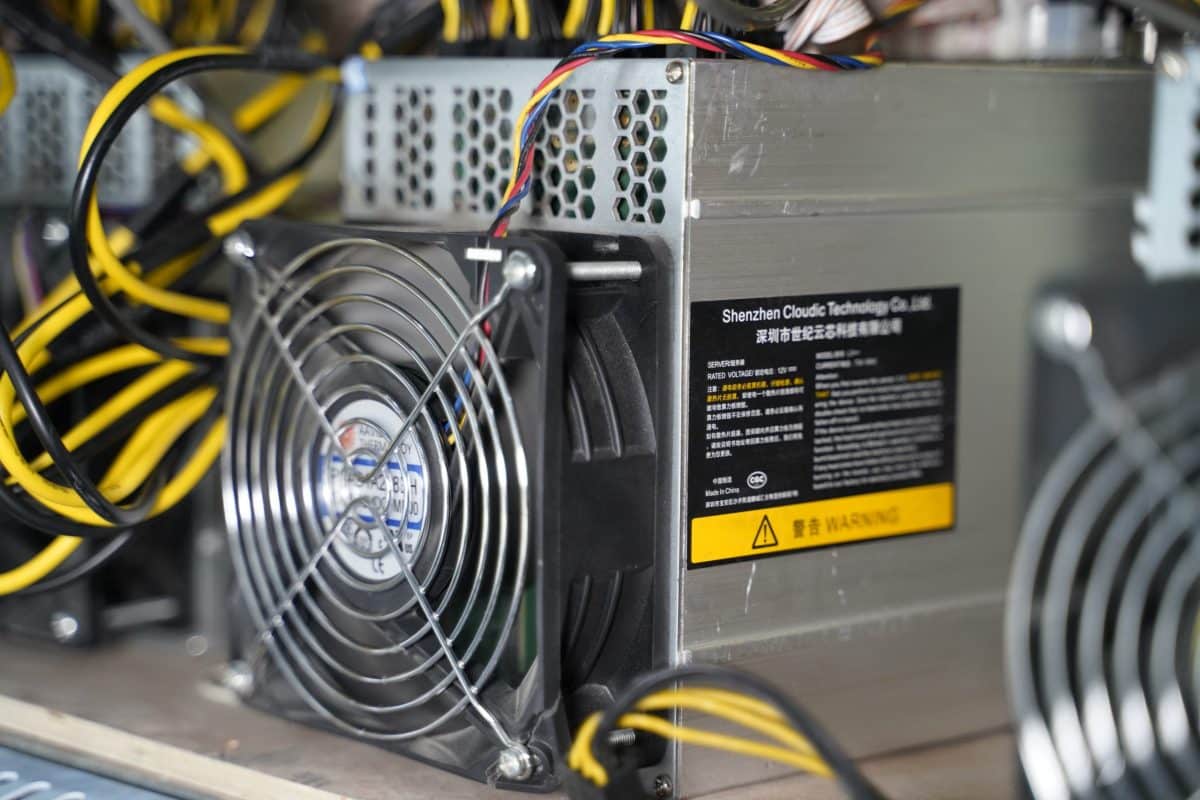

Under the service agreement, Hut 8 is expected to maintain and develop Ionic’s existing and new sites in Texas, as well as host 8,500 Ionic miners at its site in Niagara Falls, New York.

Hut 8’s CEO, Jaime Leverton, said the firm has been designing Ionic’s Cedarvale site in Texas since December, and construction is underway. The company added that it expects to “oversee 127,000 miners with a nameplate hashrate of 12 EH/s and 300 MW of energy infrastructure in year one of the managed services agreement.”

If that goes as planned, Hut 8 said the agreement is expected to bring a total cash revenue of $81.5 million, as well as equity compensation from Ionic over the next four years.

On the other hand, Hut 8 has already become a stakeholder of Ionic by acquiring shares for $6.4 million in cash and will make another acquisition in the same term before May 31.

As part of the equity investment, Hut 8 will appoint two directors to the board of Ionic Digital. One of them will be USBTC’s co-founder, Asher Genoot, who is currently Hut 8’s president.

Hut 8 completed the merger with USBTC late last year, which now operates proprietary bitcoin mining, colocation, high-performance computing, and managed services. It also won a bid in Canada to acquire four distressed gas power generation assets totaling 310 megawatts.

Celsius filed for bankruptcy protection in 2022 amid the crypto market downfall. As part of the reorganization plan approved by the bankruptcy court last year, Celsius will distribute liquid assets to customers while exiting the Chapter 11 case as purely a bitcoin mining firm owned by its customers.

Share This Post: