Amid the recent market pullback, bitcoin’s hashprice has dropped below a critical level for many mining companies to break even in a post-halving scenario.

Data from Luxor shows that bitcoin’s hashprice, the dollar amount of revenue expected from each PH/s of computing power, has again broken $80/PH/s and is around $76.5/PH/s as of writing.

The hashprice decline followed bitcoin’s 20% price correction after it briefly hit $49,000 on Jan. 11 when a dozen bitcoin spot ETFs began trading. The price of bitcoin is changing hands at just below $40,000.

Meanwhile, bitcoin’s three-day moving average network hashrate has recovered to 520 EH/s after dipping to 450 EH/s as miner operators in Texas curtailed power to strengthen the grid during a 3-day cold outbreak.

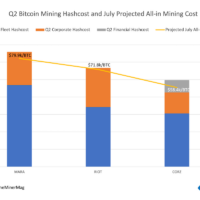

TheMinerMag’s data shows that the median fleet hashcost of 17 mining companies in North America was around $40/PH/s in Q3. This is a critical level for many of them to break even and make gross profits.

If bitcoin’s hashprice remains at $80/PH/s before April 22, the currently estimated date for the halving event, it will be reduced to $40/PH/s immediately on April 23.

Many mining companies could be mining at a gross loss in that case unless they manage to substantially improve their fleet efficiencies during Q4 and Q1.

Bitcoin’s hashprice potentially halving to $40/PH/s after April 22 also has a significant implication for Bitmain, the world’s largest miner manufacturer that owns a substantial proprietary mining capacity.

Bitmain is hosting 4.1 EH/s of S19jXPs at Core Scientific’s facility for $0.0745/kWh. Its self-mining and cloud mining arm BitFuFu operates 15.1 EH/s of hashrate as of June 30, most of which were S19XPs, at an average electricity cost of $0.0738/kWh.

With an efficiency of 22J/TH, an S19XP needs bitcoin’s hashprice to be $39.6/PH/s to break even at an electricity rate of $0.075/kWh. It remains to be seen if bitcoin’s hashprice will plunge to anywhere below that after halving.

Share This Post: