NYSE-listed BIT Mining (BTCM) is selling the bitcoin mining pool business operated under BTC.com for $5 million, nearly three years after it bought the brand from Bitmain.

BTCM, formerly known as the Chinese sports lottery firm 500.com, announced on Friday that it is selling the pool business to a company in Hong Kong called Esport-Win Limited. It appears, though, that BTCM will continue to hold the BTC.com domain and the blockchain explorer.

According to BTCM’s annual report for 2022, its mining pool business booked revenue of $593.2 million from the total block rewards it mined. But nearly 99.7% of that was effectively recorded as a cost of revenue ($591.5 million) that was paid to miners connected to its pool service.

That implied a gross margin of less than 1%. Based on BTCM’s release on Friday, the pool business incurred a net loss of $2.6 million in 2022 after factoring in other relevant expenses.

As previously reported, BTC.com is one of the several FPPS pools that appear to have been partnering with Antpool for payout financing. BTCM said BTC.com is not only losing money but has also accumulated $11 million in net cryptocurrency liabilities.

Although BTCM did not provide details on the buyer, corporate filings in Hong Kong and China suggest the directors behind Esport-Win are also business partners of BTCM’s current CEO Xianfeng Yang.

Based on the annual filing of Esport-Win in Hong Kong, its director is a person called Dan Lu. Chinese corporate records show that Esport-Win Hong Kong has a fully-owned subsidiary in China called Shenzhen Esport-Win Information Technology Limited with a legal representative called Tao Liu and a supervisor also called Dan Lu.

Further records of Lu and Liu show that they have formed other business entities together with BTCM’s Yang. In addition, the three held various roles over the years in now-dissolved companies with other executives who are now behind 500.com.

BTCM officially pivoted from sports lottery to bitcoin mining in 2021 after a few years of work behind the scenes in China. It had plans to scale up operations in the U.S. following China’s mining ban but that did not materalize compared to other U.S. mining operations.

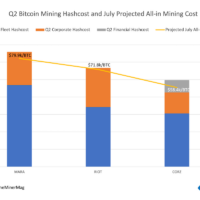

For the first three quarters this year, BTCM mined 133 BTC with a revenue of $3.1 million and recorded $12.2 million in merge-mining revenues from LTC and DOGE.

Share This Post: