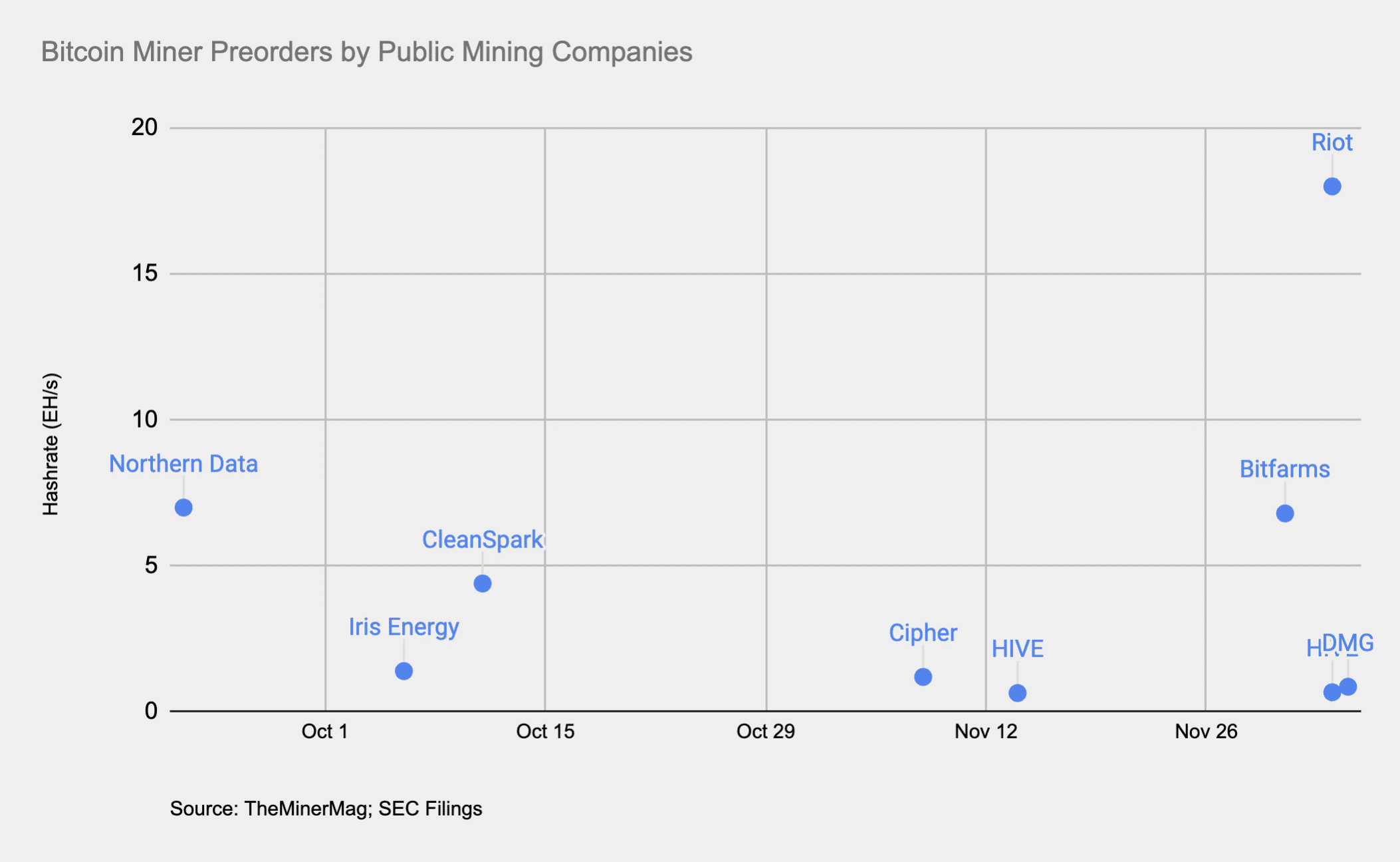

A list of publicly traded bitcoin mining companies has signed purchase orders over the past three months for spot or future stocks of bitcoin mining hardware, totaling more than 40 EH/s.

Based on the disclosed transaction details, these purchase orders amount to an investment commitment of more than $620 million that will be paid to Bitmain and MicroBT as deliveries start next year.

Since late September, the companies that have announced preorders for the latest generation of bitcoin miners include Northern Data, CleanSpark, Cipher Mining, HIVE Digital, Iris Energy, Bitfarms, and Riot Platforms.

DMG Blockchain is the latest mining firm to announce, on Tuesday, the purchase of Bitmain’s Antminer T21 model, which has a built-in energy-switching function for overclocking.

These bulk purchases and increasing investment commitments come amid bitcoin’s market rally since mid-October, reaching $42,000 for the first time since April 2022.

TheMinerMag’s data shows that aggregated net spending on property, plant, and equipment (PP&E) by publicly traded mining companies has already been rising during the first nine months as broader market conditions improved.

13 North American mining companies tracked by TheMinerMag incurred total net spending of $310 million in Q3 on PP&E, up from $160 million and $270 million in Q1 and Q2, respectively.

Share This Post: